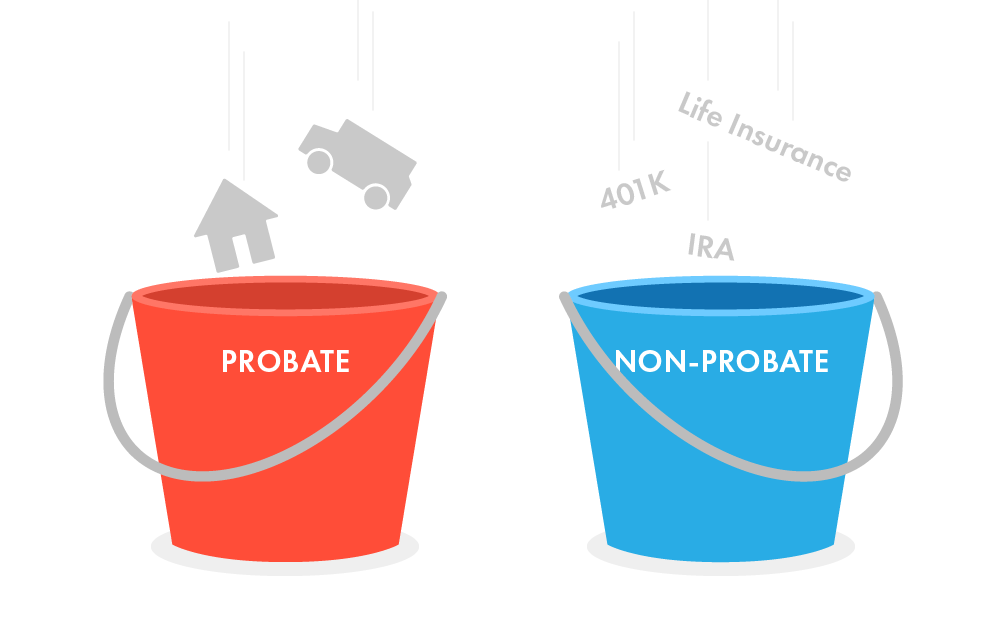

Certain assets are not distributed during probate but are transferred through contracts. These assets are called the non-probate assets and transfer directly from the company or bank holding them to the beneficiary named in the account documents.

Non-probate assets are those assets that pass according to a right of survivorship, pay-on-death (POD) or transfer-on-death (TOD) designation. Upon a decedent’s death, his or her non-probate assets pass directly to the joint owner with rights of survivorship or the designated beneficiaries and are not subject to the probate process.

Non-probate assets can include life insurance policies, IRAs, KEOGHs, pensions, profit sharing, 401(k) plans, and property held in a trust or with “Right of Survivorship”. These assets are transferred directly from the trustee, company, or bank holding them to the beneficiary who is named in the policy or account documents.

In most instances, creditors of an estate cannot reach non-probate assets. However, accounts titled as POD or TOD may be liable to the personal representative for amounts owed by the estate to pay off unpaid creditor claims after probate assets are exhausted. In these circumstances, the beneficiary is not liable to pay more then he or she received from the account.